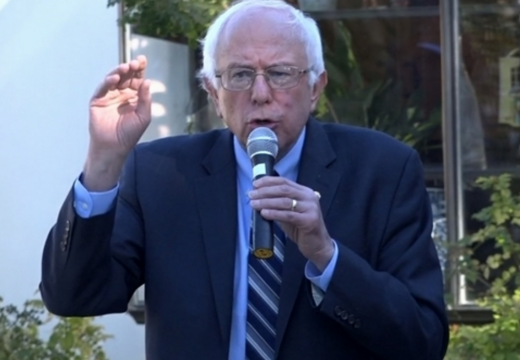

With the upcoming elections and potential for Bernie Sanders or Hilary Clinton to end up in the White House, there is a lot of uncertainty regarding the housing market. Many believe their new tax plan could send rates through the roof, and that spells bad news for homeowners. The best solution to this unmitigated disaster is to lock in your interest rate now, before the Federal Reserve raises interest rates on mortgages yet again.

There has never been a better time to refinance your home. That’s because of a little-known government program called the Home Affordable Refinance Plan® (HARP). This allows Americans to refinance their homes at shockingly low rates, and reduce their payments by an average of $3,300 a year.

But here’s the catch – like most government programs, this is likely temporary. Currently the program is set to expire on December 31, 2016. But the good news is, once you’re in, you’re in. If the thought of a lower payment or fewer years on your mortgage sounds appealing, the time to act is right now.

Quick Version: Smart homeowners are using a free government program to save as much as $3,300 a year on mortgages. There’s absolutely NO COST to see if you qualify. Click here instantly to see if you qualify.

It’s like a true middle-class stimulus package

This is unknown to many, but the Home Affordable Program is for the middle class. If your mortgage is $625,500 or less (unless you live in a high-cost area then the loan limits may be higher), you most likely qualify. Basically, the Government wants banks to cut your rates, which puts more money in your pocket (which is good for the economy). However, the banks aren’t too happy about this – here’s why:

- You can shop several lenders, not just your current mortgage holder

- Your home’s Loan-to-value (LTV) can be 80% to 125%

You think banks like the above? Rest assured, they do not. They’d rather keep you at the higher rate you financed at years ago. That’s why the pressure is on time-wise. The Middle Class seems to miss out on everything (did you ride the last stock bubble? Probably not). Thus, it’s almost a no-brainer to jump on this now. You need to act fast in order to refinance your house at these current low refinance rates. You can greatly benefit:

- The average monthly savings for most eligible Americans is $275. Can you use an extra $275 a month?

- Many homeowners not only save every month, but depending on their current rates, they can also shorten their term.

Almost a million homeowners could still save money, but sadly, most of them think the HARP program is too good to be true. Remember, HARP is a free government program and there’s absolutely NO COST to see if you are eligible.

Instantly see online >>

This is why it’s a no-brainer – you will likely lower your payment, possibly shorten your term, AND can also get cash. This is how powerful that little word called “interest” is. The middle class never sees “breaks” like this. So this is your chance to get “in”.

This often overlooked method to lower your payment (and continue to make the higher payment by directing the excess to the principal) is a great way for you to pay off your mortgage in a shorter period of time, all the while saving more money in interest over the life of the loan.

But how do you find these rates?

Here’s the answer – there are a few free websites out there that will compare mortgage rates for consumers, and allow them to choose the best one (that’s a great thing about the internet – it allows you to do business with lending institutions all over the country).

HARP Refinance, one of the country’s largest and most respected mortgage refinance comparison shopping websites, is one of the few companies with HARP lenders on its network, and is currently assisting homeowners like you to obtain further information regarding superb mortgage rates.

With HARP Refinance there’s no obligation and the service is fast & easy. It takes about five minutes, and the service is 100% free. You have nothing to lose except money stress.

But you do have to act before rates rise.

Select your state: